Like a homesick camel plodding through the arid wastelands of American finance, the Buck-O-Quest Economic Survival Series staggers on past the once-thought insurmountable limits of my attention span, to its long awaited end, providing readers with one last dose of hope, inspiration, and questionable financial advice.

We begin today’s thought-enraging lesson with a letter from yet another satisfied literary consumer.

Dear Author,

I am not impressed with the flippant and frankly irresponsible tone you have taken in your self-proclaimed Economic Recovery series. These are serious financial problems we are dealing with, requiring serious measures to be implemented by serious people. I would suggest your words and your time would be better spent in helping your readers climb out of debt and develop fiscally responsible habits to help them stay on the road to solvency. If this proves too difficult for you, please at least get some better jokes.

Disgustedly

Robert B. Pukensmite,

Rising Tide, FL

,

Robert,

Thank you for writing, I can’t tell you how much I appreciate reader feedback, even when it comes from a communist like yourself.

Although I find your concept of personal responsibility very amusing, the truth is that you simply cannot fault the American people for living beyond their means, or financial institutions for encouraging them to do so.

Lenders lend, consumers consume, and bankers bank on the hope that this cycle will provide them with a comfortable living for some time to come. This is the nature of global finance. If you must bring responsibility into this issue be sure to lay the blame where it belongs, which of course is with our money.

As everyone knows, the U.S. currency is a timid and cowardly thing, always seeking security in numbers. Those with small reserves of cash are in constant danger that their meager supply will escape and seek out the company of larger corporate accounts.

Clearly what we need is a way to train our legal tender and instill it with discipline and obedience, just like major financiers do.

That’s right Robert, unknown to the less lucratively-endowed citizenry, millionaires and multinationals alike have long relied of the services of exclusive financial obedience schools to train their vast collections of currency to circulate carefully through the markets and return home, followed closely by droves of stray, undisciplined bills.

Although many Americans lack available funds for instruction, not to mention the sizable fees charged by more illustrious services, there are resources at hand for those willing to start somewhat smaller.

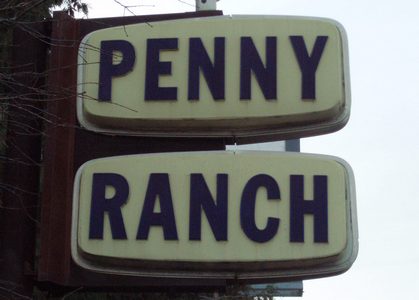

With the help of more modest monetary obedience institutions like the Penny Ranch, average citizens can corral their loose change, preventing its usual vending machine-driven stampedes, and even herd it toward more useful investments.

Thank you again for writing, Robert. The next time you have a brilliant economic breakthrough, please contact my associate Lastdollar Don who I’ve recently subcontracted to handle helpful individuals like yourself.

Came in late? Don’t miss a single installment of the Buck-O-Quest extravaganza.

Part 1- Taking Economic Recovery For A Spin

Part 2- Putting The Economy In Motion

Part 3 – Shoring Up Liquid Assets

Part 4 – The Buck Stops at Last

Bonus – What The Promised Recession Means To You

Bonus 2 – Stimulus Package Video

Any other readers with questions or burning concerns to address may do so through the convenient and sturdy-looking Ominous contact page, where they will be routed to the appropriate website personality for eventual response.

This post is all the rage at alltop.com

It is also plummeting faster than gross adjusted median incomes over at humor-blogs.com.